Get Ready for Higher Blu-ray Prices: The Tariff Impact on Physical Media

Physical media isn't dead yet, but the new US tariffs from the White House are certainly not going to help.

Physical media has been in a delicate state for years now. It has been caught in a perfect storm with the rise of digital alternatives, streaming services, and shifting consumer habits, especially in the world of movies. The new wave of U.S. tariffs, however, might be the final straw that pushes an already struggling industry to the brink, at least for mainstream audiences and retailers.

I’m not ready to call physical media dead yet. There have been so many clickbait posts like this for years now, often with not much research or thought behind them. Most of them are simply reactionary articles tying small industry changes to some undefined larger impact that can’t be quantified. But these tariffs are a real, quantifiable threat to this industry, and this is the most worried I have been about the market in some time.

So before we start writing the obituary for physical media, let’s take a step back and explore what these tariffs could really mean, and, crucially, what the industry can do to weather this storm and keep physical media alive, even if it might be completely different than what we are used to.

An Already Struggling Industry Faces New Challenges

In 2024, U.S. physical media sales for movies dipped below $1 billion for the first time in decades, a clear a sign that even the die-hard physical media enthusiasts couldn’t prevent the ongoing decline. I have always thought we were getting close to a plateau, but it seems the market hasn’t hit that yet. To put this all into perspective, in 2019, physical movie sales still exceeded $2 billion. That’s a more than 50% drop in just a few years, and the tariffs may exacerbate this trend even further.

Tariffs, especially the 25 percent tariff on goods from Mexico, are hitting the Blu-ray industry particularly hard. Why? Because Mexico is a major hub for manufacturing Blu-ray discs destined for the U.S. market. Check any of your recent movie purchases - chances are you will see “Disc Made in Mexico” printed on the back. Studios that rely on pressing plants in Mexico, Taiwan, and Japan will be seeing significant price hikes on their products. The impact could result in higher production costs, fewer releases, and even more limited-editions, boutique releases, and steelbooks priced at $40 or higher.

This isn’t entirely on the tariffs. Prices have already been going up over the past few years as the shrinking market and inflation have caused margins to dry up. The days of the $20 new release movie have been gone for a while, and $30-$35 is a new normal. Now throw the tariffs on top of that, and we are looking at a potential tipping point where movies start to become too expensive even for the most hardcore collectors.

Take, for example, the big boutique labels like Arrow Video or Criterion, both of which already release limited runs of films at premium prices. These labels are likely to feel the pinch more than big studios, whose high volume production models allow them to absorb costs more effectively. But even the big studios have begun to raise prices to keep pace, especially as their typical “high volume” production models have likely shifted closer to medium or low volume production models in the past five years. Their margins are already thin, and adding tariffs on top of shipping and manufacturing costs could force them to rethink their entire strategy, because tariffs don’t effect digital goods.

For example, say an indie label or studio is currently making a $5 margin on their physical media releases sold for $25, and a $15 margin on the same movie sold digitally for $25. The math already isn’t in physical media’s favor, but there has been enough volume to justify the sales. Tack on an additional tariff of 25% and the margin on physical media gets cut even further while the digital movie remains untouched. Now I am not an economist, but I can do basic math. If you were running that business and wanted to be successful, you’d be pushing the digital copies and seriously considering dropping physical media. The math just doesn’t favor physical media.

Despite all of this, it’s not all doom and gloom. A quick rollback of tariffs could lead to a sharp drop in prices, which could allow physical media to rebound. If tariffs were reversed, production costs could drop significantly, leading to a faster return to more affordable pricing. There could also be a revival of disc pressing in the United States, but the increased overhead and labor of doing that work here would likely outweigh the benefit of avoiding the tariff - there is obviously a reason why they outsourced so much of this in the last decade. If the tariffs remain in place for the long term, I would predict that the market could see even fewer mid-tier releases on Blu-ray, more movies that become digital exclusives, and a sharp shift to higher-end, collector-focused editions, with equally high-end price tags. For now, I would gobble up all the cheap releases you can.

The Resilient Independent Labels: A Bright Spot in the Storm

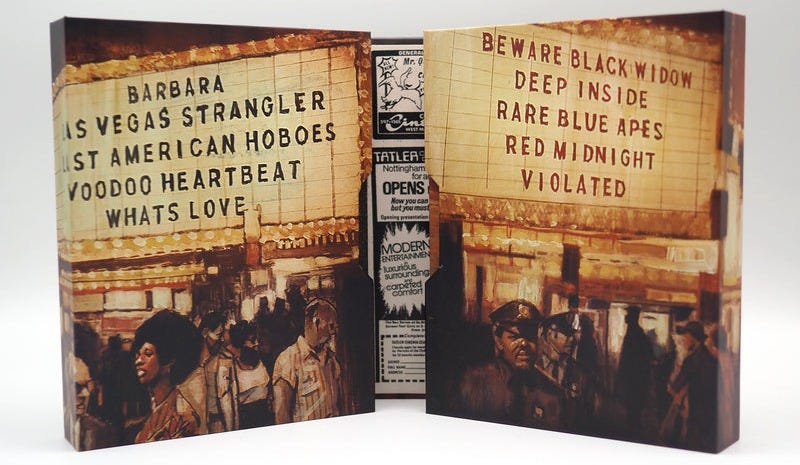

Amid the challenges that large studios and major distributors face, independent labels in the U.S. have been steadily growing and succeeding, even in the face of digital dominance. Companies like Vinegar Syndrome, Severin Films, and Kino Lorber are proving that there’s still a market for physical media when it comes to niche genres and collector-driven releases. These labels have been able to carve out a sustainable business by focusing on cult classics, limited runs, and exclusive content that’s difficult, if not entirely impossible, to find elsewhere.

Interestingly, many of these independent labels may not be hit as hard by the tariffs, or at least be better prepared to weather the storm. These companies have cultivated loyal fanbases and communities who value the premium quality and limited editions they offer and are used to higher prices in return for the premium packages they have come to expect. Many of them also manufacture their products domestically, reducing the impact of tariffs on their pricing models. For these labels, the primary challenge will be how to balance increased production costs, inflation, and a shrinking market while maintaining demand for their physical releases.

A Challenging but Not Impossible Future

While the tariffs on Blu-rays will undoubtedly create some short-term instability, it's important to remember that physical media isn’t dead yet. The industry has faced similar challenges in the past and managed to adapt. A rollback of tariffs could offer the relief needed to stabilize production and keep prices within a reasonable range. However, even without that, physical formats will continue to have a place, especially in niche markets driven by collectors who see value in the tangible experience of owning a disc, a vinyl record, or a game cartridge.

The future of physical media will likely see a shift toward more premium, limited-edition releases. This has already been happening for well over a decade, where fans are willing to pay more for collectible packaging, exclusive features, and numbered editions. Many of the so-called “boutique” Blu-ray labels didn’t even exist before 2015, well into the life of the format. So this shift has been years in the making, and is now coming to a head. For collectors, this shift toward premium releases and limited editions may actually be an exciting new phase. But for the mainstream market? The $20 new release movie may be a thing of the past. I fully expect $30 to $35 to be the new normal list price, which makes the economics of streaming or digital rentals more attractive than ever.

For now, the future of physical media continues to hang in the balance. But with dedicated independent labels and passionate fans still in the game, there’s still plenty of hope for the world of Blu-ray and DVD and I for one will be standing there until the end alongside the rest of the collectors out there who understand the importance of a physical copy.

Excellent article, Jeff. Very well-written. These tariffs are worrisome for physical media. But your article gives me hope. While increased prices on PM wouldn't cause me to stop buying movies & shows, it may force me to buy less. If that's the case for many other PM collectors, too, I hope the boutique labels can stay afloat. Thank you for shedding light on this troubling and unnecessary situation. Here's hoping we can see it through.

Don’t even wanna know what books are gonna cost